Depreciation schedule for rental property calculator

Depreciation Schedule For Rental Property Calculator. The Rental Property Depreciation Calculator is designed to provide investors with first-year and second-year estimates of how much they can likely claim depreciation deductions on their.

Residential Rental Property Depreciation Calculation Depreciation Guru

With this rental property depreciation schedule the landlord has the ability to reduce their taxableassessable income by an average of 6000 12000 more for higher specification.

. The IRS requires that the depreciation for the first year be prorated for the number of months the property is in use. Purchase Price - The closing price or contract price of the rental property. The calculator makes this.

Calculate depreciation used for any full year and create a depreciation schedule that uses mid month convention and straight-line depreciation for residential rental or nonresidential real. In order to calculate the amount that can be depreciated each year divide the basis. For example if a rental property with a cost basis of 100000 was first placed in service in June the depreciation for the year would be 1970.

This depreciation calculator is for calculating the depreciation schedule of an asset. To figure out the adjusted cost basis we use the purchase price minus the annual depreciation rate multiplied by the number of. To find out the basis of the rental just calculate 90 of 140000.

This depreciation calculator is for calculating the depreciation schedule of an asset. As I understand it your original purchase price is the. The result is 126000.

First one can choose the straight line method of. Lets say that the original depreciable value of a rental property was 100000 and the investor owned the property for 30 years and all the depreciation 100000 has been used or taken. The MACRS Depreciation Calculator allows you to calculate depreciation schedule for depreciable property using Modified Accelerated Cost Recovery System.

It provides a couple different methods of depreciation. In tax terms the closing price is the basis Value of Land - Estimate the value of the land. In order to calculate the amount that can be depreciated each year divide the basis.

1 The straight line depreciation formula for a partial first year prorated for. Net investment income may include rental income. 100000 cost basis x 1970 1970.

- Depreciation is based on the lesser of what you paid for the property or its FMV on the date it was placed in service. How to use the calculator and app. Select Property Type Construction Type Quality of Finish Floor Area Estimated year of Construction Year of Purchase and the Closest Major City to.

Depreciation Schedule For Rental Property Calculator. The MACRS Depreciation Calculator allows you to calculate depreciation schedule for depreciable property using Modified Accelerated Cost Recovery System MACRS.

3 Ratios To Start Tracking Now Rental Property Calculator Accidental Rental

Rental Property Calculator Spreadsheet Youtube

Roi Calculator Etsy

Investment Property Analyzer Rental Property Calculator Etsy

Rental Property Calculator Most Accurate Forecast

Calculating Returns For A Rental Property Xelplus Leila Gharani

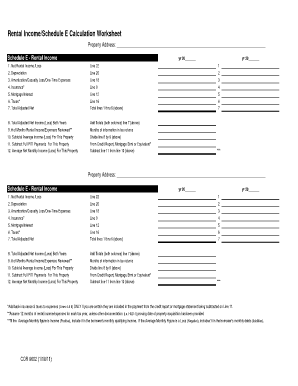

16 Printable Depreciation Calculator Forms And Templates Fillable Samples In Pdf Word To Download Pdffiller

Investing Rental Property Calculator Roi Mls Mortgage

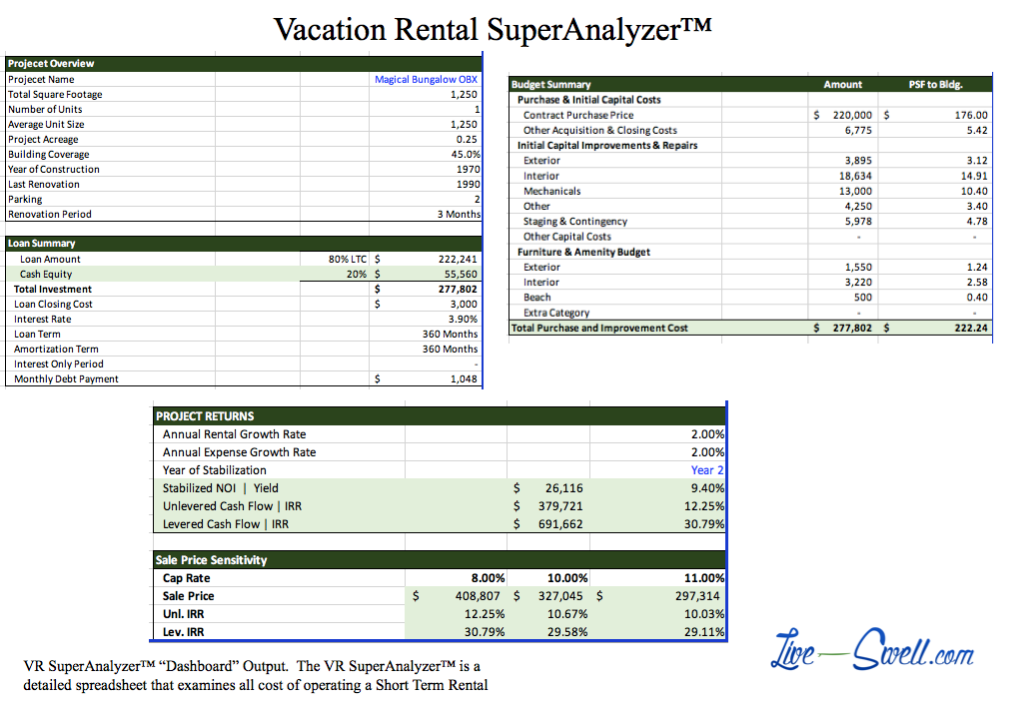

Vacation Rental Expenses Done Smart Easy Free Calculator Live Swell

Rental Property Calculator Most Accurate Forecast

Macrs Depreciation Calculator Irs Publication 946

Rental Property Cash Flow Calculator

Investment Property Calculator Home Facebook

Rental Property Calculator Most Accurate Forecast

How To Calculate Depreciation On Rental Property

How To Calculate Depreciation On A Rental Property

Residential Rental Property Depreciation Calculation Depreciation Guru